How European Union Drives Adoption to Build the World’s First Hydrogen Economy: Hydrogen Power Policy and Regulatory Push

The European Union has emerged as the global leader in establishing comprehensive policy frameworks that drive hydrogen adoption in power generation, creating a regulatory environment that positions hydrogen as a cornerstone technology for achieving energy independence and climate neutrality. Through interconnected strategies including the European Hydrogen Strategy, REPowerEU Plan, and extensive regulatory frameworks, EU policymakers have constructed an ambitious roadmap that fundamentally transforms how hydrogen integrates with power systems while establishing Europe as the world’s first hydrogen economy at scale.

The European Hydrogen Strategy Framework

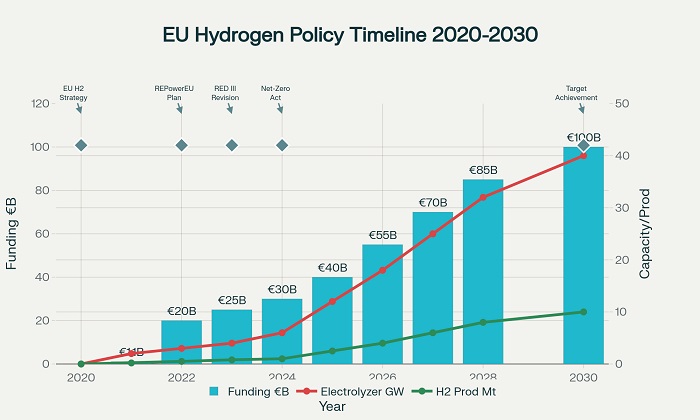

The European Hydrogen Strategy, launched in July 2020, establishes the foundational policy architecture that governs hydrogen development across the European Union, setting ambitious targets that require massive expansion of hydrogen production and utilization across all sectors including power generation. The strategy defines three distinct phases that progressively scale hydrogen deployment from demonstration projects to full integration within European energy systems.

Phase One, spanning 2020-2024, focuses on decarbonizing existing hydrogen production while establishing the technological foundations for broader deployment. The European Commission targets installing at least 6 GW of renewable hydrogen electrolyzers by 2024, producing up to one million tonnes of renewable hydrogen annually. This phase emphasizes scaling up manufacturing capabilities for large electrolyzers up to 100 MW capacity while establishing regulatory frameworks essential for market functioning.

Phase Two, covering 2024-2030, represents the critical scaling period where hydrogen becomes integral to European energy systems. The strategy mandates installing at least 40 GW of renewable hydrogen electrolyzers within the EU by 2030, producing up to 10 million tonnes of renewable hydrogen annually. Additionally, the strategy targets an additional 40 GW of electrolyzer capacity in neighboring countries to supply European hydrogen demand through imports.

Phase Three, extending from 2030 toward 2050, envisions renewable hydrogen technologies reaching full maturity and deployment across all hard-to-decarbonize sectors. By 2050, renewable hydrogen should cover approximately 10% of the EU’s total energy needs, fundamentally transforming energy-intensive industrial processes and transportation systems while providing essential grid balancing services for renewable electricity systems.

The strategy explicitly recognizes hydrogen’s critical role in power generation through its potential to enable seasonal energy storage, provide dispatchable generation that complements renewable resources, and facilitate sector coupling that optimizes energy utilization across electricity, heating, transportation, and industrial applications.

REPowerEU and Energy Independence

The REPowerEU Plan, launched in May 2022 following Russia’s invasion of Ukraine, dramatically accelerated European hydrogen policy development by positioning hydrogen as essential infrastructure for achieving energy independence from Russian fossil fuels. This strategic pivot elevated hydrogen from a long-term decarbonization tool to an urgent energy security imperative that requires immediate and substantial policy support.

REPowerEU establishes the ambitious target of producing 10 million tonnes of domestic renewable hydrogen and importing an additional 10 million tonnes by 2030, effectively doubling the original European Hydrogen Strategy targets. This acceleration reflects hydrogen’s strategic importance for reducing European dependence on natural gas imports while maintaining industrial competitiveness and grid reliability during the energy transition.

The plan identifies hydrogen as one of six critical components for increasing resilience, security, and sustainability within European energy systems, alongside energy savings, supply diversification, clean energy acceleration, smart investments, and strategic cooperation. This framework positions hydrogen power generation as essential infrastructure rather than optional technology, justifying substantial public investment and regulatory support.

REPowerEU allocates €20 billion in new grants specifically for hydrogen-related investments through national Recovery and Resilience Facility plans, while providing an additional €5.4 billion from the Brexit Adjustment Reserve that member states can voluntarily transfer to finance hydrogen measures. These financial commitments demonstrate unprecedented political support for hydrogen development at speeds that exceed private sector investment capabilities.

The strategy also doubles Horizon Europe investments in the Clean Hydrogen Partnership with an additional €200 million, specifically targeting the development of Hydrogen Valleys that integrate hydrogen production, storage, and utilization within coordinated regional ecosystems. These demonstration regions serve as testing grounds for hydrogen power generation technologies while establishing replicable models for broader European deployment.

Regulatory Framework and Technical Standards

The European Union has developed the world’s most comprehensive regulatory framework for hydrogen power applications, establishing technical standards, certification schemes, and market mechanisms that provide investment certainty while ensuring safety and environmental integrity. The Hydrogen and Decarbonized Gas Market Package, enacted in 2024, creates dedicated infrastructure regulation and market structures specifically designed for hydrogen systems.

The Renewable Energy Directive, revised in 2023, establishes binding targets for renewable hydrogen uptake in industry and transport sectors by 2030, creating guaranteed demand that supports hydrogen power generation investments. The directive requires industry to source 75% of hydrogen from renewable sources by 2030, increasing from the original 50% target, while transport sectors must achieve 5% renewable hydrogen utilization, up from 2.6%.

Delegated Acts on renewable hydrogen, adopted in June 2023, provide precise definitions and criteria for products qualifying as renewable hydrogen, establishing the regulatory certainty essential for large-scale investment. These acts specify temporal correlation, geographical correlation, and additionality requirements that ensure electrolytic hydrogen production uses genuinely renewable electricity rather than grid electricity with mixed sources.

The temporal correlation requirement mandates that hydrogen production occurs within the same hour as renewable electricity generation, ensuring direct utilization of renewable resources. Geographical correlation requires hydrogen production within the same bidding zone as renewable generation, preventing artificial geographic arbitrage that might undermine renewable energy development.

Additionality requirements ensure that renewable electricity used for hydrogen production comes from new installations that add capacity to the system rather than diverting existing renewable generation from other uses. These requirements prevent hydrogen production from increasing overall electricity demand without corresponding renewable capacity additions.

Exemptions to these stringent requirements apply to member states with high renewable energy penetration or low-carbon electricity grids, simplifying hydrogen production requirements where grid electricity already maintains low carbon intensity. As of 2023, bidding zones in Sweden and France qualify for these exemptions, with Finland, Austria, and Slovakia expected to meet criteria in coming years.

Financial Mechanisms and Investment Support

European hydrogen power policy incorporates sophisticated financial mechanisms designed to bridge the gap between current hydrogen costs and commercial viability, recognizing that policy support remains essential for establishing hydrogen markets at required scale and speed. The Strategic Interventions for Green Hydrogen Transition program provides targeted financial incentives for both electrolyzer manufacturing and hydrogen production.

The Innovation Fund, financed through EU Emissions Trading System revenues, specifically supports hydrogen power generation projects through grants covering development and demonstration costs. The first funding rounds allocated €109 million to five hydrogen projects under small-scale calls and €1 billion to three hydrogen projects under large-scale calls, demonstrating substantial financial commitment to hydrogen power technologies.

Important Projects of Common European Interest provide another crucial funding mechanism for hydrogen power infrastructure, enabling member states to coordinate support for strategic projects that span multiple countries. Four waves of hydrogen IPCEIs have received approval, facilitating billions of euros in coordinated public investment that supports hydrogen power generation development.

National Recovery and Resilience Plans incorporate substantial hydrogen investments, with 15 EU countries including hydrogen measures totaling €9.3 billion in their recovery programs. These coordinated national investments create economies of scale while ensuring coherent hydrogen power development across European markets.

The European Investment Bank provides dedicated financing facilities for hydrogen projects, offering favorable terms that reflect hydrogen’s strategic importance for European energy security and climate objectives. EIB financing often catalyzes additional private investment by reducing project risks and improving financial returns for hydrogen power generation investments.

Carbon pricing through the EU Emissions Trading System provides implicit support for hydrogen power generation by increasing the cost of carbon-intensive alternatives. Current carbon prices exceeding €80 per tonne improve the competitiveness of hydrogen power while generating revenues that fund hydrogen development through the Innovation Fund.

Market Development and Demand Creation

European hydrogen power policy employs multiple mechanisms to create sustained demand for hydrogen that justifies large-scale production investments while ensuring market development proceeds at sufficient pace to meet energy security and climate objectives. Mandatory targets across multiple sectors create guaranteed hydrogen demand that supports power sector investments.

The Renewable Energy Directive establishes binding sectoral targets for renewable fuel consumption that create substantial hydrogen demand across industry and transport applications. These mandates ensure that hydrogen production capacity utilization remains high while providing long-term demand certainty essential for investment decisions.

RefuelEU Aviation mandates sustainable aviation fuel blending requirements reaching 6% by 2030, with e-fuels required to comprise 1-2% during 2030-2034. This creates substantial demand for renewable hydrogen as feedstock while demonstrating hydrogen’s potential for enabling aviation decarbonization through power-to-liquid fuel production.

FuelEU Maritime establishes greenhouse gas intensity reduction trajectories for maritime fuels that indirectly encourage renewable hydrogen utilization either directly as fuel or as feedstock for synthetic fuel production. These measures create additional hydrogen demand while demonstrating hydrogen’s versatility across multiple applications.

Public procurement requirements increasingly specify renewable hydrogen utilization across government operations, creating early market demand while demonstrating hydrogen’s reliability and performance. These requirements help establish supply chains and reduce costs through guaranteed demand that supports private sector investment.

Competitive bidding mechanisms aggregate demand and procurement for green hydrogen and hydrogen derivatives, creating transparent price discovery while ensuring efficient allocation of public support. These mechanisms help establish market prices while supporting hydrogen power generation projects through long-term purchase commitments.

International Cooperation and Trade Policy

European hydrogen power policy extends beyond internal market development to establish international cooperation frameworks that position Europe as the hub of global hydrogen trade while supporting hydrogen power generation development in partner countries. Strategic partnerships with neighboring regions create hydrogen supply chains that enhance European energy security while promoting hydrogen power technologies globally.

The Southern Neighborhood initiative identifies hydrogen production as a strategic priority, with the EU targeting at least 40 GW of electrolyzer capacity in EU neighboring countries by 2030. This external capacity development creates hydrogen import opportunities while supporting European technology exports and industrial competitiveness.

Eastern Partnership cooperation, particularly with Ukraine, establishes frameworks for renewable electricity and hydrogen development that can supply European markets while supporting partner country economic development. These partnerships create win-win scenarios that enhance European energy security while promoting hydrogen power generation technologies internationally.

The Africa-EU Green Energy Initiative, launched in February 2022, includes clean hydrogen production as one of three main pillars, creating opportunities for large-scale hydrogen imports while supporting African renewable energy development. These partnerships demonstrate hydrogen’s potential for enabling global clean energy trade.

Technical standards harmonization through international partnerships ensures that European hydrogen power technologies can compete effectively in global markets while facilitating technology transfer that accelerates global hydrogen deployment. The International Partnership for Hydrogen and Fuel Cells in the Economy provides coordination mechanisms for developing common standards and best practices.

Trade policy increasingly reflects hydrogen’s strategic importance through provisions that support hydrogen technology exports while ensuring that imported hydrogen meets European sustainability standards. These measures protect European hydrogen industries while promoting global adoption of European hydrogen power technologies.

Implementation Challenges and Adaptations

Despite comprehensive policy frameworks, European hydrogen power development faces significant implementation challenges that require continuous policy adaptation and refinement. Current progress falls substantially short of policy targets, with only 2% of listed electrolysis capacity having advanced beyond Final Investment Decision stage as of 2023, reflecting barriers that policy mechanisms must address more effectively.

Electrolyzer manufacturing capacity constraints represent a critical bottleneck, with current European production capacity under 1 GW annually compared to the 40 GW target by 2030. Policy responses include the Net-Zero Industry Act, adopted in June 2024, which specifically targets 100 GW of electrolyzer manufacturing capacity by 2030 while supporting European industrial competitiveness in hydrogen technologies.

Complex approval processes for funding allocation create delays that jeopardize project timelines and investment confidence. Typical approval periods of 12-24 months for public funding conflict with rapidly evolving technology costs and market conditions, requiring streamlined procedures that maintain oversight while enabling faster deployment.

Temporal and geographical correlation requirements for renewable hydrogen create additional costs and complexity that may impede near-term deployment while ensuring long-term sustainability. Policy adaptations balance environmental integrity with practical implementation requirements, potentially allowing transitional arrangements that support market development.

Grid integration challenges for large-scale electrolysis installations require coordinated planning between hydrogen development and electricity infrastructure investments. Policies increasingly recognize these interdependencies through integrated infrastructure planning requirements and coordinated investment support.

Skills and workforce development requirements for hydrogen power generation exceed current educational and training capacity, necessitating coordinated programs that ensure adequate human resources for industry scaling. The Strategic Hydrogen Innovation Partnership addresses these needs through coordinated research, development, and training initiatives.

Future Policy Evolution and Global Impact

European hydrogen power policy continues evolving to address emerging challenges while maintaining leadership in global hydrogen development. The Clean Industrial Deal emphasizes hydrogen’s role in supporting European industrial competitiveness while achieving climate objectives, integrating hydrogen power generation within broader industrial policy frameworks.

Recalibration of hydrogen strategies focuses implementation on hard-to-electrify sectors where hydrogen provides unique value rather than competing with direct electrification alternatives. This targeted approach optimizes public investment while ensuring hydrogen power generation development aligns with overall system efficiency.

Enhanced international cooperation increasingly positions European hydrogen power policies as global standards that influence development worldwide. Technology exports, standards harmonization, and capacity building initiatives extend European policy influence while creating markets for European hydrogen power technologies.

The European approach to hydrogen power policy provides a comprehensive template that other regions increasingly adopt and adapt to local conditions. Success in European implementation validates policy approaches while demonstrating hydrogen power generation’s viability at scale, encouraging similar programs globally.

European hydrogen power policies establish the regulatory, financial, and market frameworks essential for transitioning hydrogen from demonstration projects to commercial deployment at unprecedented scale, creating a model that guides global hydrogen economy development while securing European leadership in this transformative technology sector.