Economics of Hydrogen-to-Power: Cost Parity, LCOE and the Investment Outlook

The economics of hydrogen-to-power generation represent one of the most dynamic and rapidly evolving segments within the global energy sector, driven by declining production costs, improving technology performance, and strengthening policy support mechanisms. Understanding hydrogen power economics requires comprehensive analysis of levelized cost of electricity frameworks that account for the unique characteristics of hydrogen fuel cycles, infrastructure requirements, and operational flexibility values that distinguish hydrogen systems from conventional power generation technologies. As hydrogen production costs approach economic competitiveness and power system requirements increasingly value dispatchable clean generation, hydrogen power economics demonstrate improving viability across multiple market segments and applications.

Levelized Cost of Electricity Analysis Framework

The levelized cost of electricity for hydrogen power generation encompasses multiple cost components that reflect the complete energy conversion chain from primary energy sources through hydrogen production, storage, and electricity generation. Unlike conventional thermal generation that directly combusts primary fuels, hydrogen power systems require additional conversion steps that introduce complexity while providing unique operational advantages.

Current hydrogen power LCOE calculations indicate costs ranging from $80-150 per megawatt-hour depending on hydrogen production pathways, storage requirements, and generation technologies employed. These costs reflect substantial improvements from early estimates exceeding $200 per megawatt-hour as technology matures and deployment scales increase.

Green hydrogen power systems utilizing renewable electricity for electrolysis demonstrate LCOE values approaching $100-120 per megawatt-hour when renewable electricity costs remain below $30 per megawatt-hour and electrolyzer capacity factors exceed 4,000 hours annually. These scenarios become increasingly common as renewable energy costs continue declining and electrolyzer technology improves.

Blue hydrogen power systems utilizing natural gas with carbon capture achieve LCOE values of $70-90 per megawatt-hour, reflecting lower feedstock costs offset by carbon capture equipment and storage expenses. These systems provide intermediate emission reductions while achieving better near-term economics than green hydrogen alternatives.

The temporal variability of renewable electricity creates complex optimization challenges for hydrogen power economics, requiring sophisticated analysis of production scheduling, storage utilization, and generation dispatch that maximizes value while managing costs. Advanced optimization algorithms increasingly enable hydrogen systems to achieve capacity factors and revenue outcomes that improve LCOE calculations significantly.

Fuel cell power generation achieves electrical efficiencies of 50-60%, substantially higher than hydrogen combustion in gas turbines at 35-45% efficiency, creating significant fuel cost advantages that partially offset higher capital costs for fuel cell systems. Combined heat and power applications can achieve overall efficiencies exceeding 85%, fundamentally improving the economics of hydrogen power through waste heat utilization.

Capital Investment Requirements and Cost Trajectories

Capital expenditure requirements for hydrogen power generation systems vary dramatically based on technology selection, scale, and integration approaches, with costs continuing to decline as manufacturing scales and technology matures. Current capital costs range from $2,000-6,000 per kilowatt for complete hydrogen power systems, including production, storage, and generation components.

Electrolyzer capital costs represent a major component of hydrogen power system investments, currently ranging from $1,500-2,500 per kilowatt for PEM systems and $800-1,500 per kilowatt for alkaline systems at industrial scale. Industry projections indicate potential cost reductions of 50-70% by 2030 as manufacturing scales and technology improves through continued research and development.

Fuel cell system costs vary significantly between technologies and applications, with utility-scale systems achieving $3,000-5,000 per kilowatt while smaller distributed systems cost $5,000-8,000 per kilowatt. Solid oxide fuel cell systems demonstrate superior efficiency but higher capital costs, while PEM systems offer operational flexibility at moderate cost premiums.

Hydrogen storage infrastructure represents another significant capital requirement, with costs depending heavily on storage duration requirements and geological conditions. Underground storage in salt caverns achieves costs below $10 per kilowatt-hour for seasonal storage applications, while high-pressure vessel storage costs $50-100 per kilowatt-hour for shorter-duration applications.

Balance of plant costs, including power conditioning, control systems, safety equipment, and site preparation, typically represent 30-50% of total hydrogen power system capital costs. These costs benefit from economies of scale and standardization efforts that reduce unit costs as deployment volumes increase.

The capital cost trajectory for hydrogen power generation shows consistent downward trends driven by technology improvements, manufacturing scale increases, and supply chain optimization. Learning curve analysis indicates 15-20% cost reductions for each doubling of cumulative deployment, consistent with other energy technologies during scaling phases.

Operational Expenditure and Maintenance Economics

Operational expenditure for hydrogen power systems encompasses fuel costs, maintenance requirements, and auxiliary system operations that collectively determine the variable costs of electricity generation. Hydrogen fuel costs currently dominate operational expenses, representing 60-80% of total operational costs for most system configurations.

Green hydrogen production costs continue declining from current levels of $4-8 per kilogram toward projected costs of $1.5-3.0 per kilogram by 2030, driven by renewable electricity cost reductions and electrolyzer efficiency improvements. These cost reductions directly translate to improved operational economics for hydrogen power generation.

Maintenance requirements for hydrogen power systems vary significantly between technologies, with fuel cell systems requiring stack replacements every 40,000-80,000 operating hours while hydrogen gas turbines utilize conventional maintenance approaches with modifications for hydrogen-specific components. Overall maintenance costs typically range from 2-4% of capital costs annually.

Fuel cell degradation rates continue improving through materials advances and operational optimization, extending stack lifetimes while maintaining high efficiency throughout operational life. Recent improvements achieve degradation rates below 1% per 1,000 hours of operation, substantially reducing lifecycle maintenance costs.

Water consumption for hydrogen production through electrolysis requires approximately 9-11 liters per kilogram of hydrogen, creating operational costs that vary significantly based on water sourcing, treatment requirements, and local pricing. Water costs typically represent less than 5% of total operational expenses but can become significant in water-stressed regions.

Grid services revenue provides substantial operational income for hydrogen power systems through frequency regulation, spinning reserves, and other ancillary services that leverage hydrogen systems’ rapid response capabilities. These services can generate $10-30 per kilowatt annually in favorable markets, significantly improving overall project economics.

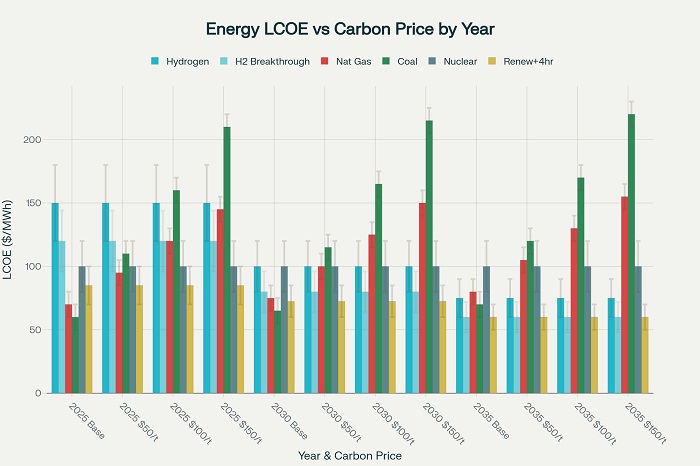

Comparative Cost Analysis with Alternative Generation

Hydrogen power economics increasingly compete favorably with alternative dispatchable generation technologies when accounting for environmental costs, operational flexibility, and long-term fuel price risks. Comprehensive comparisons must account for capacity factors, operational characteristics, and system services that determine overall value rather than simple LCOE comparisons.

Natural gas combined cycle plants currently achieve LCOE values of $50-80 per megawatt-hour depending on fuel costs and capacity factors, providing a benchmark for hydrogen power competitiveness. However, carbon pricing mechanisms increasingly penalize natural gas generation, with carbon costs of $80 per tonne adding $35-45 per megawatt-hour to natural gas LCOE.

Coal power plant LCOE ranges from $40-70 per megawatt-hour for existing facilities, though new construction costs exceed $100 per megawatt-hour while facing substantial regulatory and financing challenges. Carbon pricing affects coal generation even more severely than natural gas, adding $70-90 per megawatt-hour at carbon prices of $80 per tonne.

Nuclear power demonstrates LCOE values of $80-120 per megawatt-hour for new construction while existing plants achieve much lower operational costs. However, nuclear plants lack the operational flexibility of hydrogen systems and face substantial stranded asset risks in markets with high renewable penetration.

Renewable energy plus battery storage achieves LCOE values of $60-100 per megawatt-hour for 4-hour storage duration, though costs increase substantially for longer storage durations that hydrogen systems provide cost-effectively. Hydrogen power systems become competitive with battery storage for applications requiring storage durations exceeding 10 hours.

Peaking power applications demonstrate particularly favorable economics for hydrogen systems, which can provide rapid response capabilities without minimum run times or startup costs associated with conventional thermal generation. Peaking plant LCOE values of $150-300 per megawatt-hour create favorable competitive environments for hydrogen power systems.

The integration of multiple revenue streams including energy sales, capacity payments, ancillary services, hydrogen sales, and environmental credits enables hydrogen power systems to achieve competitive total revenues that justify higher LCOE compared to single-purpose generation assets.

Investment Landscape and Financing Mechanisms

Investment in hydrogen power generation benefits from diverse financing mechanisms that reflect hydrogen’s strategic importance for energy transition while addressing unique risk profiles and return characteristics of hydrogen projects. Traditional project finance approaches adapt to accommodate hydrogen technology risks while innovative financing structures emerge to support early-stage deployment.

Government incentive programs provide substantial support for hydrogen power investments through production tax credits, investment tax credits, and direct grants that reduce project costs and improve investment returns. The United States Inflation Reduction Act provides production tax credits up to $3 per kilogram for clean hydrogen, dramatically improving project economics.

Green bonds and sustainability-linked financing offer attractive funding sources for hydrogen power projects that meet environmental criteria while providing investors with climate-aligned investment opportunities. These instruments often provide favorable interest rates and terms that improve project viability.

Development banks and multilateral financial institutions increasingly support hydrogen power projects through concessional financing, technical assistance, and risk mitigation instruments that enable deployment in emerging markets. These institutions recognize hydrogen’s strategic importance for achieving climate objectives while supporting economic development.

Corporate power purchase agreements for hydrogen-generated electricity provide revenue certainty essential for project financing while enabling corporations to meet sustainability targets through clean electricity procurement. These agreements often include premium pricing that reflects the environmental value of hydrogen power.

Hydrogen offtake agreements with industrial users create additional revenue streams that improve overall project economics while providing market certainty for investors. These dual-revenue models reduce market risk while improving capital utilization through higher effective capacity factors.

Private equity and venture capital investment in hydrogen power technologies continues increasing as technology performance improves and market opportunities become clearer. These investments support technology development and early commercial deployment while generating returns that attract broader institutional investment.

Regional Economic Variations and Market Factors

Hydrogen power economics vary substantially across different regional markets due to differences in renewable resource availability, existing energy infrastructure, regulatory frameworks, and industrial demand patterns. Understanding these regional variations guides investment allocation and technology deployment strategies.

European markets demonstrate favorable hydrogen power economics driven by high carbon prices, supportive regulatory frameworks, and substantial renewable energy resources. Carbon prices exceeding €80 per tonne significantly improve hydrogen power competitiveness while renewable electricity costs below €30 per megawatt-hour enable competitive hydrogen production.

United States markets benefit from substantial government incentives, diverse renewable resources, and growing industrial hydrogen demand that creates favorable conditions for hydrogen power development. Regional variations reflect renewable resource quality, electricity market structures, and state-level policy support that ranges widely across different jurisdictions.

Asian markets show mixed conditions with countries like Japan and South Korea demonstrating strong policy support and industrial demand while facing higher renewable electricity costs. China’s aggressive renewable deployment and electrolyzer manufacturing create cost advantages while substantial industrial demand provides market certainty.

Middle Eastern markets leverage abundant solar resources and existing industrial infrastructure to achieve competitive hydrogen production costs while facing challenges in developing power sector applications and export infrastructure. These regions demonstrate potential for becoming major hydrogen exporters while developing domestic utilization.

Australian markets combine exceptional renewable resources with growing export opportunities that can support large-scale hydrogen power development, though domestic demand remains limited compared to export potential. Regional variations reflect resource quality and proximity to export infrastructure.

African markets demonstrate substantial renewable resource potential combined with growing electricity demand that creates opportunities for hydrogen power systems, though financing and infrastructure challenges constrain near-term development. International development finance increasingly supports these markets through concessional financing and technical assistance.

Cost Reduction Pathways and Technology Learning

Hydrogen power economics continue improving through multiple cost reduction pathways that address all system components while improving operational performance and reducing risks. These improvements follow established learning curve patterns while benefiting from targeted research and development investments.

Electrolyzer cost reductions follow manufacturing learning curves that achieve 15-20% cost decreases for each doubling of cumulative production, supported by materials improvements, manufacturing process optimization, and supply chain development. Current cost trajectories indicate potential 50-70% reductions by 2030 as production scales increase.

Fuel cell cost reductions benefit from automotive industry development that drives stack improvements and manufacturing scale increases applicable to stationary power applications. Shared component development and manufacturing processes create cross-sector benefits that accelerate cost reductions.

System integration improvements reduce balance of plant costs through standardized designs, modular construction approaches, and improved supply chain coordination. These improvements achieve 20-30% cost reductions while improving installation speed and reducing project risks.

Operational optimization through advanced control systems, predictive maintenance, and performance monitoring reduces operational costs while extending equipment lifetimes. These improvements achieve 10-15% operational cost reductions while improving system reliability and performance.

Economies of scale continue reducing unit costs as project sizes increase and deployment volumes grow, with large projects achieving 20-40% lower unit costs compared to smaller installations. Standardization efforts amplify scale benefits while reducing development costs and improving performance predictability.

Research and development investments target breakthrough technologies including advanced materials, improved electrolysis processes, and enhanced fuel cell designs that promise substantial performance improvements and cost reductions beyond current learning curve projections.

Investment Risk Assessment and Mitigation

Hydrogen power investment risks encompass technology, market, regulatory, and operational factors that require comprehensive risk assessment and mitigation strategies to achieve acceptable investment returns while supporting sector development. These risks continue evolving as markets mature and operational experience accumulates.

Technology risks include performance uncertainties, durability concerns, and potential obsolescence as rapid innovation continues improving competing technologies. Risk mitigation approaches include diverse technology portfolios, performance guarantees, and insurance products that protect against technology underperformance.

Market risks encompass hydrogen price volatility, electricity price variations, and demand uncertainty that affect revenue predictability and investment returns. Long-term contracts, diverse revenue streams, and flexible operational strategies help mitigate market risks while maintaining upside potential.

Regulatory risks include policy changes, environmental requirements, and safety regulations that may affect project economics or operational requirements. Engagement with regulatory development processes and diversified geographical exposure help manage regulatory risks while supporting favorable policy development.

Operational risks encompass safety concerns, maintenance requirements, and performance degradation that affect system reliability and costs. Comprehensive operational procedures, skilled workforce development, and preventive maintenance programs minimize operational risks while ensuring safe reliable operation.

Financial risk mitigation increasingly employs innovative instruments including performance guarantees, technology insurance, and revenue support mechanisms that enable investment at acceptable risk levels while supporting technology deployment. These mechanisms become more sophisticated as markets mature and risk assessment capabilities improve.

The evolution toward lower-risk investment profiles for hydrogen power reflects improving technology maturity, growing operational experience, and developing market mechanisms that reduce uncertainty while providing attractive returns for investors across different risk tolerance levels.